Introduction

Insurance has always been thought of as complex, slow, and laden with unnecessary paperwork. The digital age has changed how customers view insurance demanding something different, defining simplicity, transparency, and flexibility. And, that is what Hepster DE is aiming for. Hepster is not another insurance company; it’s also not an insurance company at all. Hepster is an insurtech company located in Germany, with the goal of making insuring as easy as purchasing online.

In this blog post, we will dive into Hepster DE’s mission, product ecosystem, customer experience, strengths, challenges, and future prospects, so that you can understand the current attention Hepster is receiving in Germany and Europe, as well as what they need to do to meet their customer expectations more fully.

The Origins of Hepster DE

Founded in 2016 in Rostock, Germany, Hepster DE was founded by Christian Range and Hanna Bachmann. They had a clear intention from the outset: transforming the traditional insurance experience into a digital-first experience. Rather than paperwork, the need for in-person consultation and waiting, Hepster sought to provide pace and control by utilizing a solely online experience.

From their headquarters in Rostock, Hepster quickly gained traction with customers and investors. In 2021, Hepster completed a $10 million Series A investment led by Element Ventures. This investment was used to scale up its insurance ecosystem, focusing on e-mobility insurance and embedded insurance for digital businesses.

Two years later in July 2023, Hepster raised another €10 million in Series B funding. This round of funding was essential to Hepster’s next phase of growth, profitability. By 2025, Hepster is projected to have approximately 129 employees, and an estimated annual revenue of €26.5 million ($28.4 million). Clearly, this is not just a startup play anymore this is a legitimate player in the German insurance, and possibly the international insurance, ecosystem.

Hepster DE’s Mission and Philosophy

The essence of Hepster is simple: to offer flexible, transparent, and fully digital insurance products. Their principles are based around three key ideas:

- Insurance should be easy. Customers should be able to buy coverage online in under 5 minutes with minimal bureaucracy.

- Insurance should be flexible. Insurance should fit as easily into the customer’s lifestyle, whether it is a one week cycle tour or ongoing insurance for their pet.

- Insurance should be clear. No hidden terms and conditions, no complicated language, just direct coverage information.

This philosophy resonates strongly with modern consumers, especially younger consumers who appreciate both convenience and digital-first products.

The Product Ecosystem of Hepster DE

Hepster DE’s vast product selection is also one of its greatest strengths. Unlike traditional insurers that sell only standardized life or car insurance, Hepster builds coverage around lifestyle.

1. Bicycle and E-Bike Insurance:

For example, cycling is becoming extremely popular in Germany with the emergence of the e-bike. They have special bicycle and e-bike insurance to cover theft, accidents, and even breakdown assistance. In addition, unlike traditional rigid policies, Hepster allows you to specify a duration of coverage of a week, month, or longer term. This flexibility is especially useful for people that rent bicycles, travel, or test e-bikes before purchase.

2. Electronics Protection:

Our devices have become our lifelines in the digital age. Hepster covers smartphones, laptops, cameras, tablets and smartwatches. They offer coverage for accidental damage, theft, and in many cases, worldwide coverage, which is great for frequent travelers.

3. Pet Health Insurance:

For pet owners, the expense of veterinary bills can be daunting. Hepster provides insurance for dogs and cats, including health and surgical options. This is especially attractive for a younger pet owner who wants flexibility and options that won’t break the bank.

4. Travel Insurance:

Another aspect with which Hepster excels is Travel Insurance. Customers can use Hepsters insurance to:

- Work and Travel Insurance

- Foreign Medical Insurance

- Trip Cancellation Insurance

- Travel Accident Insurance

These insurances are great for digital nomads, students on exchange and frequent travelers looking for comfort abroad.

5. Liability Insurance:

Accidents occur. Hepster provides personal liability insurance in everyday life, covering claims for lost keys, volunteering, damage to third party property, etc.

6. Embedded Insurance for Businesses:

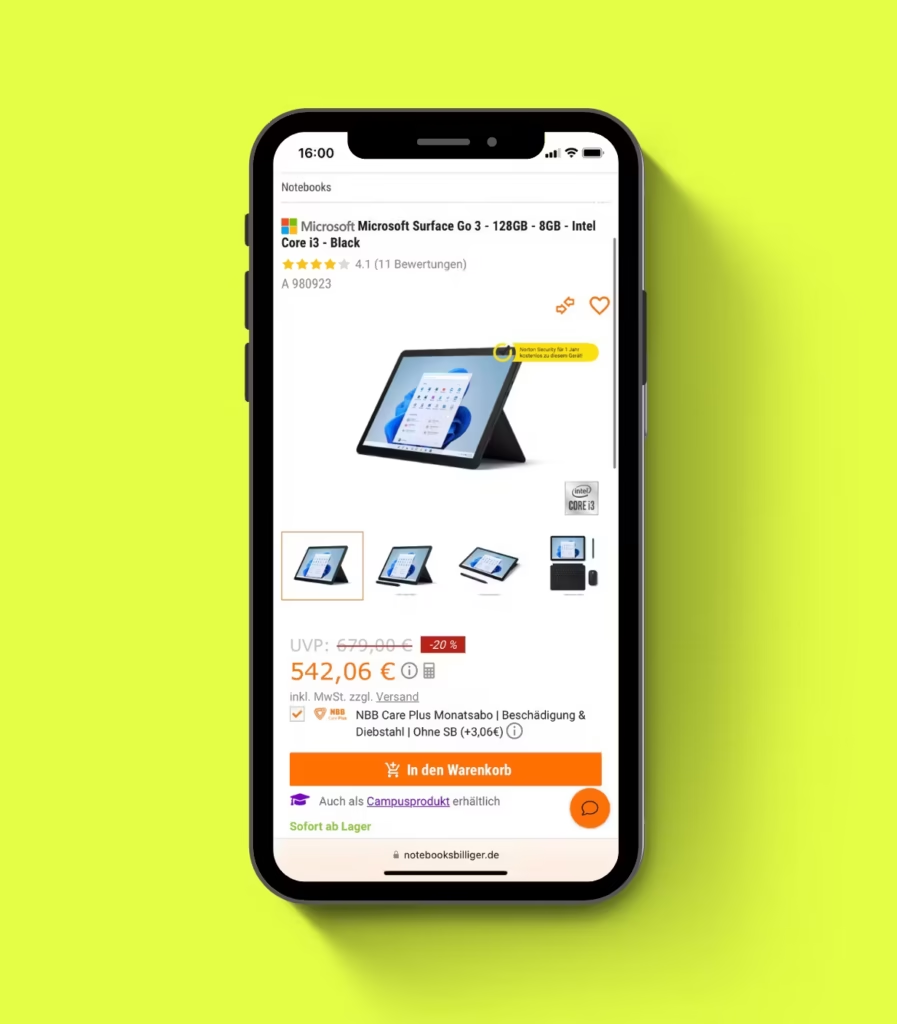

The feature that potentially stands out the most about Hepster’s ecosystem is its B2B embedded insurance arrangements. Retailers, bike shops, and e-commerce businesses can get Hepster coverage included in their checkout process. In the world of e-commerce, this means that during your purchase when you buy your e-bike, you can include Hepster insurance in the transaction with a click or two. The potential profitability from the embedded model for businesses seems infinite as it provides convenience for customers while also opening up new revenue streams for them.

How Hepster DE Works: The Customer Journey

Hepster caught people’s eye for many reasons, but one major part of it is the easy and digital-first process. The customer journey typically has three easy steps:

1. Select Your Coverage:

Customers first select the type of insurance they are looking to buy bike, travel, pet, electronics, or liability. Then they can select the duration, any extras they want, and the start date.

2. Checkout and Payment:

After the coverage has been selected, it is placed in the online cart. While checking out, the customer provides relevant details, such as a bike serial number or smartphone IMEI, and the payment is securely processed through a partner (for example Adyen).

3. Instant Confirmation:

About 5 to 10 minutes later, the customer receives an email with all of the relevant documents, including the policy certificate, product information, and the terms and conditions. The whole thing is 100% digital, which means no paperwork is exchanged, no postal letters to wait on, and no need to go to an office for delivery.

Customer Experiences with Hepster DE

When scrutinizing customer sentiment, Hepster DE receives varying opinions. This split is fundamental for potential new users.

Feedback:

Many customers appreciate the speed, modernness, and flexibility:

- “Really great, simple, modern, digital experience.” – Trustpilot, August 2025

- “I got reimbursed in full for a stolen bike worth €250 in 1.5 months.” – Trustpilot, January 2024

Positive reviewers stress speed of claims, digital experience, and fair price.

Strengths of Hepster DE

Hepster DE has a lot of things going for it, and while some critics may wish to emphasize negatives, Hepster has some solid positives:

- Digital First Simplicity: No paperwork, instant quotes, online management.

- Customizable Coverage: Customers can select what they wish.

- Wide Variety of Products: From bicycles to electronics to pets.

- Embedded B2B Model: Automatically added in, during retail checkout.

- Financial Backing and Growth: Millions of startup funding received, if to take others down more they protect their footing.

Challenges and Weaknesses

At the same time, Hepster has major challenges to overcome:

- Claims Handling Problems: Trust is damaged by unpredictable experiences.

- Transparency Issues: Indefinite terms create dissatisfaction.

- Delays with customer service: Slow response time lowers satisfaction.

- Reputation Threat: Nearly half of Trustpilot reviews are negative.

Hepster needs to tackle these issues, if they want to be successful long-term.

The Future of Hepster DE

Going forward, Hepster DE has a bright future if they focus on a few key improvements:

- Simplified Claims: quicker and clearer claims flow.

- Support: quicker and empathetic communication.

- Consumer Knowledge: clearer documentation and FAQs.

- B2B Opportunities: more embedded partnerships with retailers.

- Brand Reputation: publicize customer success stories, and customer satisfaction.

If Hepster can accomplish these improvements, you will be well on your way to establishing your position as the leading Digital Insurance in Germany.

Conclusion

Hepster DE is not merely an insurance company, it’s a digitization revolution in the insurance company. With flexible bicycle insurance, electronics, pet insurance, travel insurance, and liability insurance, Hepster is addressing modern lifestyles.

Its core competency is simplicity, customizability, and being digital first. Its core issue is claims handling and customer service, which add to user frustration.

For now, Hepster is a potential leader in German insurtech, and slowly but surely developing as a company. If they get to the next level of claims handling and customer service, it will be a trustworthy presence in German insurance landscape. It will really deliver on its promise of making insurance as simple as online shopping.